Short-Term Incentives: 2020 Review and 2021 Challenges

- POE Group

- Jan 11, 2021

- 3 min read

Updated: Jul 27, 2022

The COVID-19 pandemic has had a substantial impact on revenue and earnings for businesses across the country.

While 2020 is complete and results are generally known, 2021 will continue to be heavily influenced by volatile economic conditions — not only lingering COVID-19 concerns, but also potentially policies of the new administration.

What Approach Will Companies Take with Short-Term Incentive Plan Payouts?

As 2020 incentive plans conclude and 2021 plans begin, companies should consider the impact of the pandemic on short-term incentive plan payouts — specifically, whether payouts are warranted, and if so, whether it is appropriate to apply discretion in order to adjust bonus amounts.

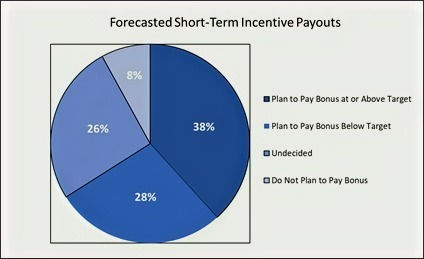

A survey of 705 organizations conducted by Willis Towers Watson in late September 2020 found that the majority of companies (66%) still plan to pay out annual bonuses in 2021.

Of the remaining companies, 26% had not made a decision on incentive payouts, and the remaining 8% did not plan to pay bonuses in 2021 for performance results tied to 2020.

Of the 66% of companies that said they plan to pay out bonuses, 58% forecast payouts to be at the target level or higher. In total, this means that only about 38% of surveyed companies expect to pay bonuses that are at or above their target level.

Different Impact on Different Industries

As we discussed in a previous article, companies fall into three categories with respect to COVID-19 pandemic impact: those that have experienced a serious and sudden decline in revenue, those that have experienced a moderate decline in revenue, and those with increased revenue due to an uptick in demand for their product or service.

Since each of these three situations is unique, the implications for incentive plans, especially short-term plans, vary based on the projected business results. And what about pay disparity for top executives and their company performance?

When looking at 2020 performance, the decision of whether to use discretion to adjust incentive payouts must be weighed against the impact on other stakeholders and the company’s past incentive pay practices.

For many companies, that decision will depend on how successful they were at navigating the challenges posed by COVID-19, and how well-positioned they are for future growth. These factors may influence the level of incentive payouts, even though weathering the pandemic was not part of the goals set early in the year.

2021 Incentive Strategies

As 2021 begins, finance and human resources departments have two main tasks to consider. The first is to finalize payouts for 2020, which would likely be paid out in the first three months of 2021, and the second is to set goals and performance metrics for 2021.

Determining appropriate metrics and performance levels for 2021 will certainly be challenging, as many organizations base their performance goals on some type of increase above the prior year’s results.

Since 2020 results are an anomaly, issues may arise if 2021 goals are based on actual performance in 2020. If 2020 financial results were poor, should 2021 goals be set lower than historical norms? If the pandemic buoyed financial results, should similar outsized performance be expected for 2021?

Further reading: To Pay or Not Pay Short-Term Incentives in the Year of the Pandemic

Transparent Employee Communication is Important

Regardless of whether a business is booming or struggling to stay afloat, it is crucial to communicate the pandemic’s effect on incentive compensation to employees.

If companies decide to forego incentive plan payouts, they need to communicate this to employees before the date that payments would otherwise occur. On the other hand, if results are positive, communicating that the company is doing well will provide reassurance to employees that bonus payments are likely to happen as usual.

We encourage companies to provide open, honest, and transparent communication about the pandemic’s impact on incentive plans and, if any changes are made, to notify those who will be affected as soon as possible to manage expectations.

- Joe Kager, Managing Consultant at The POE Group. Joe is a Certified Compensation Professional with over twenty-five years of experience in compensation and human resources. Call him at 813-546-8628, or email him directly at joe.kager@poegroup.com

Comments